التقارير المالية

التقارير المالية هي حجر الاساسي في أي عمل صحي. إنها بمثابة نافذة على الصحة المالية لشركتك، مما يوفر رؤى قيمة حول أدائك وربحيتك وإمكاناتك المستقبلية. تمامًا كما تساعدك خريطة الطريق على التنقل في رحلتك، ترشدك التقارير المالية نحو اتخاذ قرارات مستنيرة وتحقيق أهداف عملك.

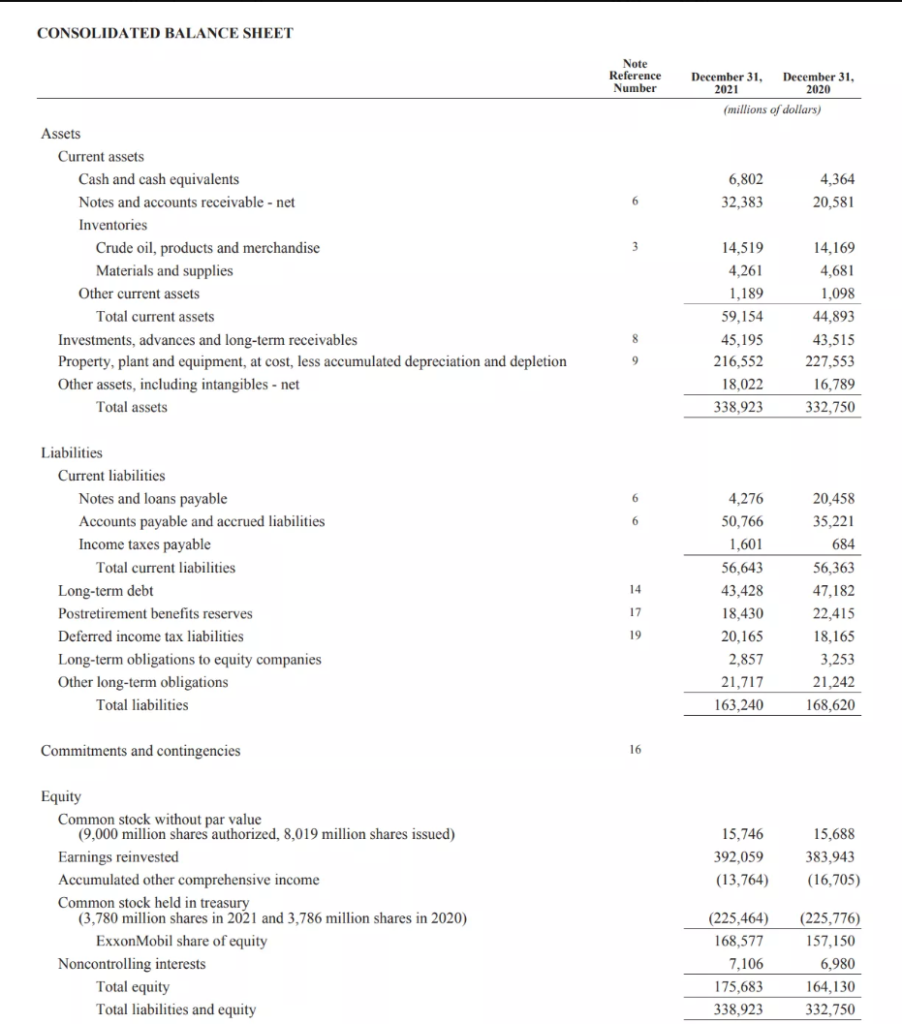

Balance Sheet

This report provides a snapshot of your company’s financial position at a specific point in time. It outlines your assets (everything you own), liabilities (what you owe), and shareholder equity (the difference between assets and liabilities). Think of it as a photograph of your business’s net worth on a particular day.

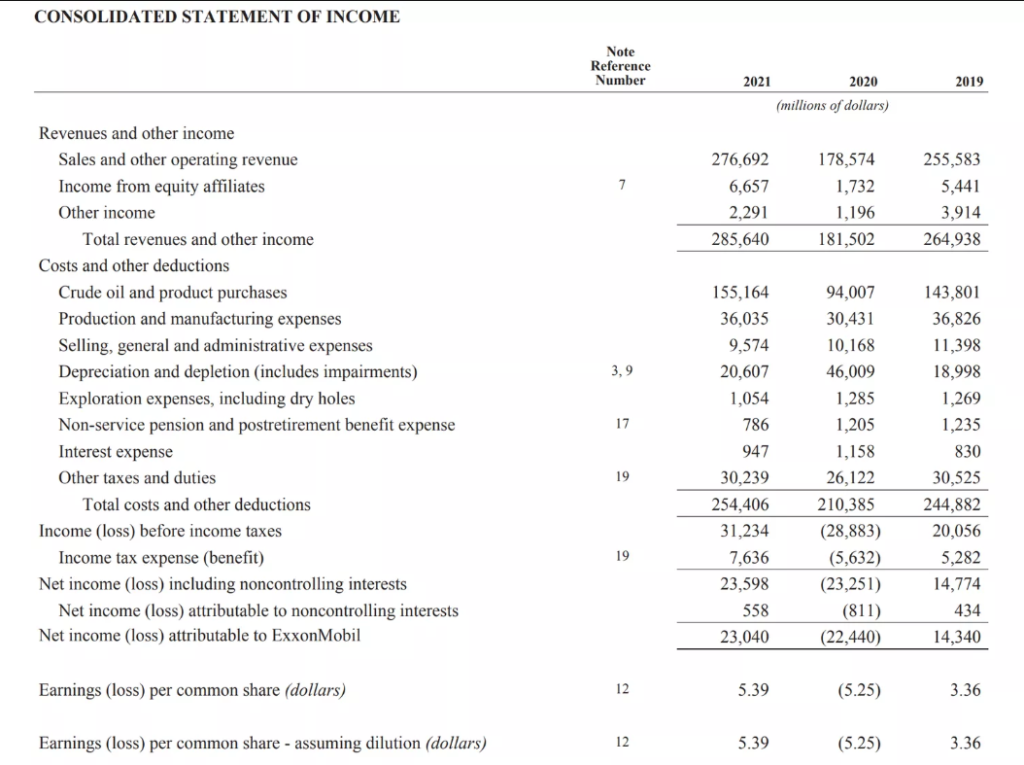

Income Statements

This report summarizes your company’s revenue and expenses over a specific period (usually a month, quarter, or year). It reveals your profitability by showing how much money you’ve earned (revenue) compared to how much you’ve spent (expenses).

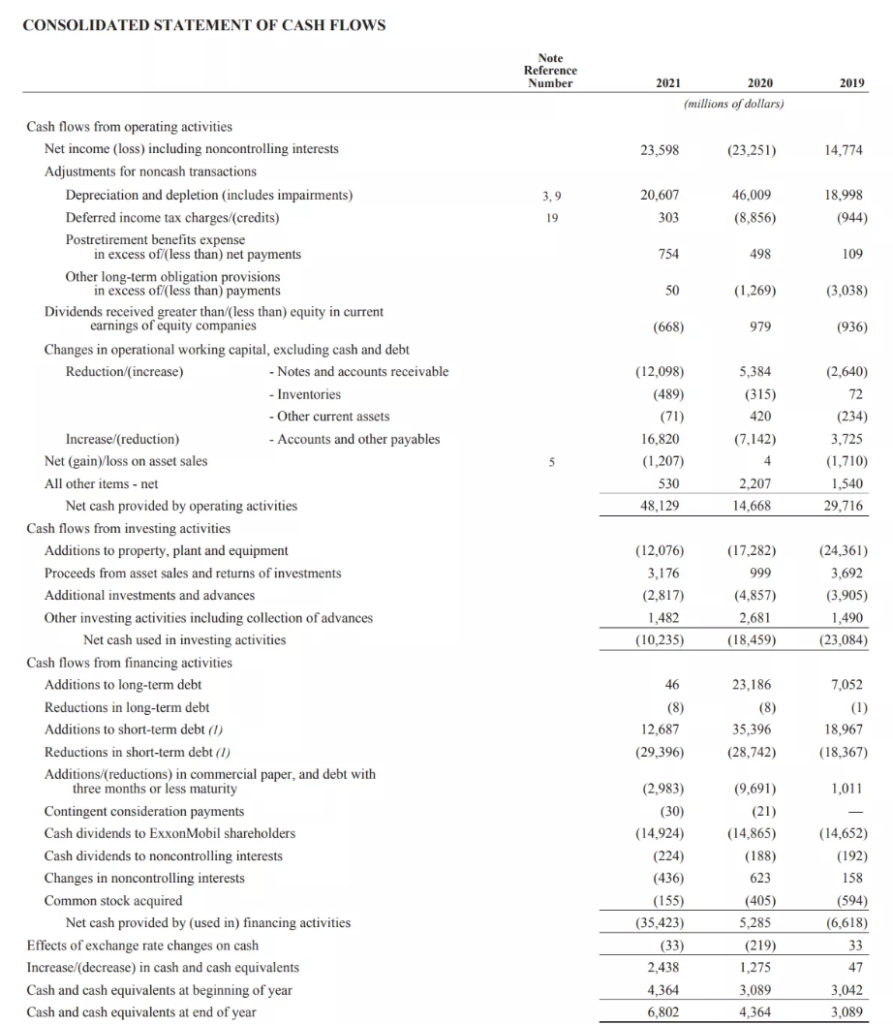

Cashflow Statement

This report focuses on the movement of cash in and out of your business. It helps you understand how you’re generating and using cash, ensuring you have enough to meet your financial obligations and support growth.

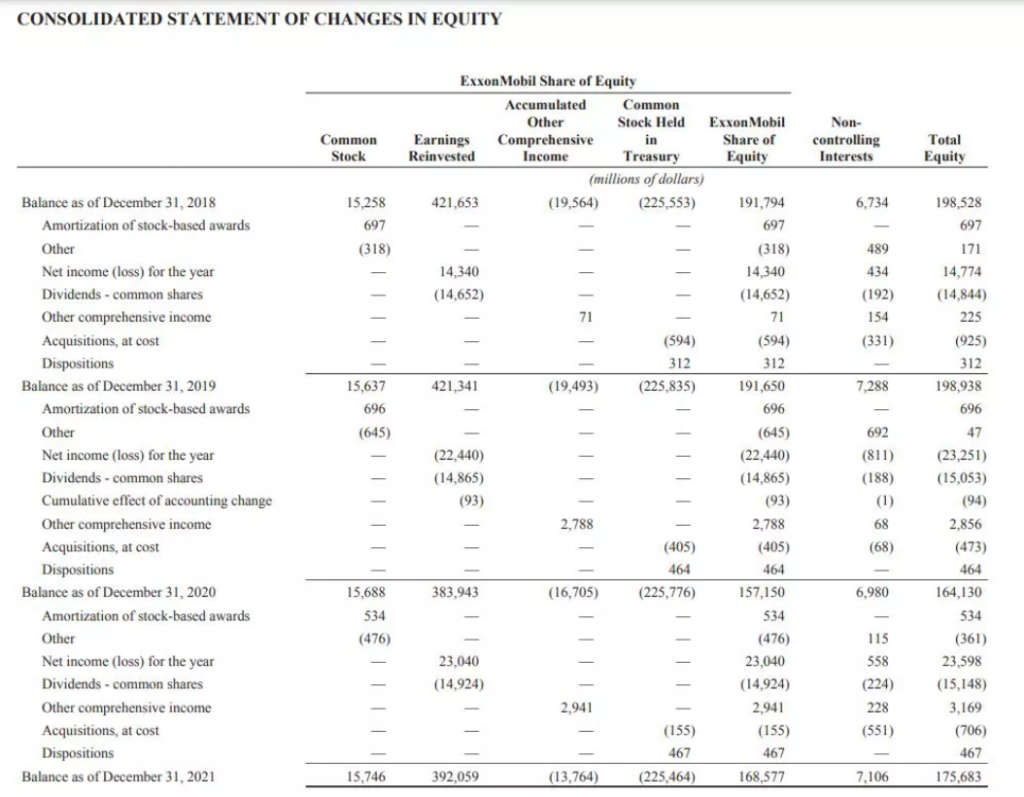

Statements of Shareholders' Equity

A short paragraph describing exactly what this service offers and how it helps clients. This is your chance to convince the visitor that your business is the right choice for them.

FAQ

What financial reports do you generate?

We provide a range of financial reports, and customized managerial reports tailored to your needs, such as:

- Balance Sheet: Shows assets, liabilities, and shareholders’ equity.

- Income Statement: Details revenue, expenses, and profits.

- Cash Flow Statement: Tracks cash inflows and outflows.

- Notes to Financial Statements: Additional details and context.

- Statement of Changes in Equity: A business’ financial statement that measures the changes in owners’ equity throughout a specific accounting period.

- Management Discussion and Analysis (MD&A): Insights from management on performance and future outlook.

- Other Customizable Reports

How do financial reports help in decision-making?

Financial reports provide detailed data on revenues, expenses, profits, and cash flows, enabling business leaders to identify trends, measure performance against goals, and make informed decisions regarding budgeting, investments, and operational strategies.

How can financial reporting improve business performance?

Financial reporting improves business performance by providing transparency, identifying areas for cost reduction, highlighting profitable activities, enabling better cash flow management, and supporting strategic planning and resource allocation.

What tools or software are commonly used for financial reporting?

Common tools and software for financial reporting include accounting software like QuickBooks, Sage, and Xero, as well as enterprise resource planning (ERP) systems like SAP and Oracle. These tools help automate data collection, processing, and report generation.

What if I don't understand a specific report or metric?

Don’t hesitate to seek clarification! Talk to your Core Consultation representative for deeper explanations. We offer explanations of key metrics and financial ratios, to make sure you have a clear financial insight.

Core Consultation: Your Financial Reporting Partner

How can I compare my performance?

Benchmarking your financial metrics against industry averages can reveal areas for improvement or highlight strengths.

What are some key metrics to focus on?

Financial reports contain many metrics, but some key ones include:

- Profit Margin: Measures profitability as a percentage of revenue.

- Debt-to Equity Rate: Indicates your reliance on debt financing.

- Current Ratio: Assesses your ability to meet short-term obligations.

How often should I review my financial reports?

The frequency depends on your business size and complexity. Regularly reviewing them (monthly, quarterly) helps identify trends and make timely adjustments.

Financial Insights

At Core Consultation, we are passionate about helping businesses unlock the power of financial insights. We go beyond basic bookkeeping and provide you with the right tools for you to lead your business to ultimate success.