Feeling overwhelmed by accounting terminology and processes? The accounting cycle (accounting process) might seem complex at first glance, but understanding its core steps empowers you to manage your business finances effectively. This accounting cycle cheat sheet provides a simplified overview, making it easier to grasp the flow of financial information within your business.

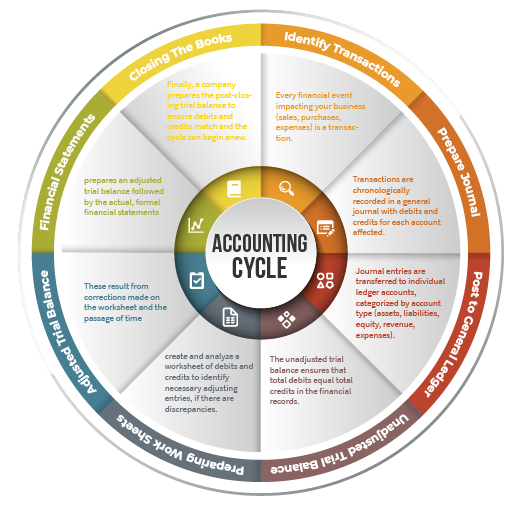

The 8 Steps of the Accounting Cycle:

-

Transactions: Every financial event impacting your business (sales, purchases, expenses) is a transaction.

-

Journalizing: Transactions are chronologically recorded in a general journal with debits and credits for each account affected.

-

Posting: Journal entries are transferred to individual ledger accounts, categorized by account type (assets, liabilities, equity, revenue, expenses).

-

Subsidiairy Ledgers (Optional): For specific accounts with high transaction volume (e.g., accounts receivable, accounts payable), detailed records can be maintained in separate subsidiary ledgers.

-

Trial Balance: A trial balance is prepared to ensure the total debits equal the total credits from all ledger accounts, verifying their accuracy.

-

Adjusting Entries: Year-end adjustments like depreciation, accrued income/expenses, and prepaid expenses are recorded to ensure financial statements accurately reflect the business’s financial position.

-

Adjusted Trial Balance: After adjusting entries, a new trial balance is prepared to confirm account balances are correct.

Financial Statements: Using the adjusted trial balance, financial reports are generated:

- Income Statement: Summarizes revenue and expenses to determine net profit or loss.

- Balance Sheet: Shows the company’s assets, liabilities, and shareholder equity at a specific point in time.

- Cash Flow Statement: Tracks the movement of cash in and out of the business.

Benefits of Understanding the Accounting Cycle:

Improve Financial Accurancy:

Proper recordkeeping ensures accurate financial statements for tax filing, decision-making, and attracting investors.

Enhanced Financial Management:

Tracking the flow of finances helps you identify areas for improvement and optimize resource allocation.

Increased Transparency:

A clear understanding of your financial cycle fosters transparency and builds trust with stakeholders.

Mastering the Accounting Cycle: Next Steps

This cheat sheet provides a foundation, but there’s always more to learn! Consider these options for further exploration:

- Accounting Software: Leverage accounting software to automate many accounting tasks, saving time and reducing errors.

- Bookkeeping Services: Outsource bookkeeping tasks to qualified professionals, freeing up valuable time to focus on running your business.

- Accounting Courses: Enroll in online or in-person accounting courses to deepen your understanding of accounting principles.

Core Consultation: Your Financial Partner

At Core Consultation, we are dedicated to empowering businesses in Kuwait with financial clarity. We offer a range of services, including:

Bookkeeping & Financial Reporting: Ensure accurate and timely financial data for informed decision-making.

Accounting Software Implementation & Training: Help you select and integrate the right accounting software for your needs.

Financial Consulting: Provide expert guidance to optimize your financial management strategies.

Contact us today for a free consultation! Let’s discuss how Core Consultation can help your business navigate the accounting cycle effectively and achieve financial success.